The UK Hagerty Price Guide has just been updated for the 29th time in its 10-year life, and as always the results can be attention-grabbing. Some Ferraris have as good as doubled in value in just 12 months, everyday classics like the MGB GT are experiencing strong demand, whereas versions of much-loved classics like the Jaguar E-Type and Aston Martin DB5 have taken a step back. Why?

Every quarter, our team of specialists look at insured values, sale prices and auction results to work out where the values are heading and we use their data and experience to publish a new version of the Hagerty Price Guide, partly so we know what’s going on in the market, but mostly so that you know what your car’s really worth.

Against a backdrop of one of the most turbulent years of recent times, the market seems very different to any other time we have published an update. Values are fluctuating sometimes wildly both up and down at both ends of the scale, but a lot of other prices are not moving more than a couple of per cent. The market is splitting, too, in a more pronounced way than seen before, as different economic pressures and incentives work on different areas of society. Here are the headlines of what is happening in the classic and collector car market, as of September 2022.

Everyman classics have seemingly increased a little in value

Hagerty’s Classic Index tracks 50 classic cars that are representative of the enthusiast market, mainly being more affordable and numerous than some of the other, rarer models we track. In the past 12 months, the Classic Index has risen by three per cent overall.

However, that’s just half the story. Actually, there’s a great deal of change with some cars moving upwards a lot, others significantly down and with 30 of the 50 moving less than three per cent in either direction.

Those moving down include the Jaguar E-Type Series III roadster, which fell by an average of nine per cent and the Audi Ur-Quattro (RR) that fell by five per cent. Both of these cars had previously risen steeply in value, and this was more of a correction than the start of a trend that Hagerty expects to continue. Similarly, Volkswagen Type 2 (split-screen) values fell by 18 per cent in the year, again having risen post-Covid when buyers may have been looking for ‘staycation’ opportunities.

Those that increased most are a diverse bunch, including some well-known classics such as the ever-popular MGB GT (up 16 per cent), the Mazda MX-5 (up 11 per cent) and the Rover SD1 3500 Vanden Plas, up a notable 23 per cent (although having started from a relatively modest £5500 average).

These are seemingly big rises, but they must be placed in context. According to the Office for National Statistics, inflation rose a shade under nine per cent (8.8, to be precise) in the year to July 2022. Only eight of the 50 cars in the Classic Index increased more than this, the remainder effectively losing value in real terms. Given the economic uncertainly and cost of living crisis, it is not surprising that the demand for many enthusiast classics seems to have subsided for now.

The most expensive cars are selling the best

Hagerty’s list of thirty of the most exclusive classics is the Gold Index. Including such cars as the Ferrari 250 GTO, the BMW 507 and the Ford GT40, the Gold Index has risen by an average of 17 per cent over the year.

Like the Classic Index, some cars have increased dramatically in value and others reduced in price. Those losing value tend to be older, more traditional classics: the Aston Martin DB5 Vantage drophead is down by 13 per cent and the Maserati 3500 GT Spyder down 18 per cent.

Interestingly, one 1950s car that has bucked this trend is the Mercedes-Benz 300SL ‘Gullwing’ coupé which has risen by 35 per cent in the year following a host of very strong sales both at auction and privately, helped in no small part by the record ‘Uhlenhaut’ coupé sale earlier this year.

Top 1970s cars have also done extremely well: Dino 246 GTS values have risen by an astonishing 89 per cent in the year, Porsche 911 2.7 RS up by 37 per cent and Lamborghini Miura P400 SV values by 29 per cent. These are interesting because Dino and 2.7 RS values had previously dipped a little, so this is a regain (and some more) whereas Miura values have been increasing for some time and this is the continuation of an upward trajectory.

Modern classic ‘halo’ cars are outperforming everything.

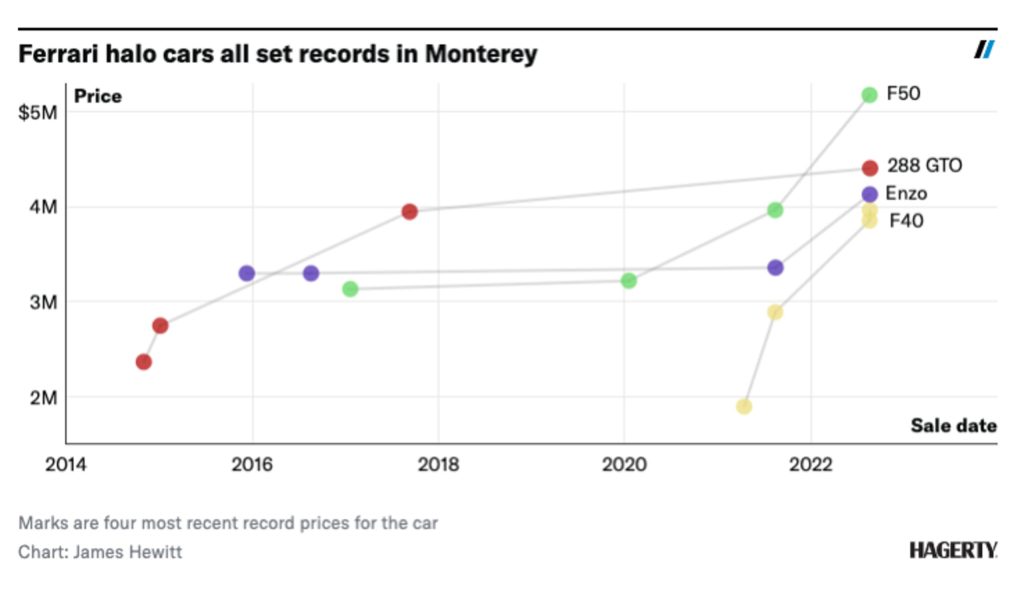

However, the most significant group of rising stars are the modern classic supercars. The McLaren F1 is up 20 per cent year-on-year, an impressive feat for a car whose average value is now a huge £15,225,000. In percentage terms though, it’s the Ferraris that are leaving the others for dust: F40 average values have almost doubled in 12 months (97.6 per cent increase), 288 GTO values are up by 71.4 per cent and F50 up by 46.7 per cent. Discounting a celebrity-owned outlier, Hagerty observed record public sale prices for the F40, F50, 288 GTO and Enzo within the space of a week at this year’s Monterey auctions.

Reading the market

It is clear that there is a lot of money being put into certain very collectable, iconic cars. These are a combination of the traditional big hitters – Gullwing, Miura, 2.7 RS – and the new elite, such as the F1 and post-1980 Ferrari ‘halo’ cars, 206/246 Dino, and Countach. These cars are certainly attracting younger buyers: Hagerty’s data shows that the average age of an F40 owner is younger than a LaFerrari owner, and we’ve seen the average age of F40, F50 and Countach owners all fall since 2020.

So, why the sudden surge in values? There may be two key reasons. One is quite dull: the Pound/Dollar exchange rate has changed significantly in the last 12 months. In September 2021, it was $1.38 to the GBP, today that’s $1.17. With more expensive cars that are traded globally, this can have a major impact.

The other reason? You guessed it: inflation. With most forecasts placing inflation at around 10 per cent in the next 12 months and all predictions pointing towards rising interest rates, there’s a huge incentive for people with money or the ability to borrow at relatively low fixed rates to buy assets. Cars are easy to buy, in the UK attract no capital gains tax, and are easy to sell if you need to. These cars are perceived as the new gold bars, and the very best examples – the correct spec, original, low-mileage or perfectly restored – are seen as great investments.

So, what is Hagerty’s outlook? For the time being, the market must remain split: the influences both economic and societal that affect the cheaper, enthusiast classics are different to those incentivising others to buy expensive collector cars to minimise the ravages of inflation. That said, as ever, Hagerty expects that the models that are collectable will change over time: we’ve already seen the Dino make that step and others like the Jaguar XJ220 and the Porsche 959 move into serious collectable territory and their values increase as a result. If interest rates – especially in the US and UK – rise significantly as expected, then this may see the current surge in demand for these halo cars recede, only for owners to store them away until inflation seemingly gives them a good return.

Meanwhile, it goes without saying that the best way to enjoy any car you may have tucked away is to get out there and drive it.

Read more

2022 Bull Market List: 10 of Britain’s hottest collectable cars

2021 was the year of the F40

Opinion: Why aren’t we allowed to buy cheap small cars any more?

Interested in your comment on TR5 values and outlook

Hi David,

The TR5 isn’t one of the cars tracked in our Classic Index but values are here: https://www.hagerty.co.uk/valuation/tool/results/?y=1967&mk=Triumph&md=TR5&sm=Base&b=Convertible