It was a strange summer here in the UK. The weather, which all Brits are obsessed with, has been unpredictable. Back in June, we sweltered in a heatwave, then by mid-July the wind became so strong that it caused the cancellation of an entire day of the Goodwood Festival of Speed for the first time in the event’s history. At the end of August, Salon Privé guests had to shelter under umbrellas as they watched the exquisite concours cars drive over the presentation ramp in front of Blenheim Palace. Less than two weeks later, the weather was so hot at the Revival that dress codes were relaxed, another Goodwood first.

We are very fortunate that our weather is not as extreme as in some other parts of the world, but it provides a great analogy to the current state of the classic car market here, blowing hot and cold with a fair degree of turbulence. A look at the headline data for the main UK summer auctions reflects that: Sell-through rates are significantly down, year-on-year, at each of the four headline auctions for Historics, Iconic (Silverstone), Gooding & Company, and Bonhams.

An obvious conclusion to draw from this data is that the market is slowing, significantly. Those four auction houses cover every aspect of the market, from the very top, £1M-plus collector zone, all the way down to the affordable, sub-£10K enthusiast area. But Hagerty doesn’t like obvious conclusions, and when we dug deeper, we found more subtle trends that suggest something different is happening.

Index Linked

First, we looked at the performance of our indices. The Gold Index, tracking blue-chip collector cars, has fallen six points since its high in March 2023, but the other four indices – Hot Hatch, Classic, Best of British, and FOTU (Festival of the Unexceptional) – have all risen.

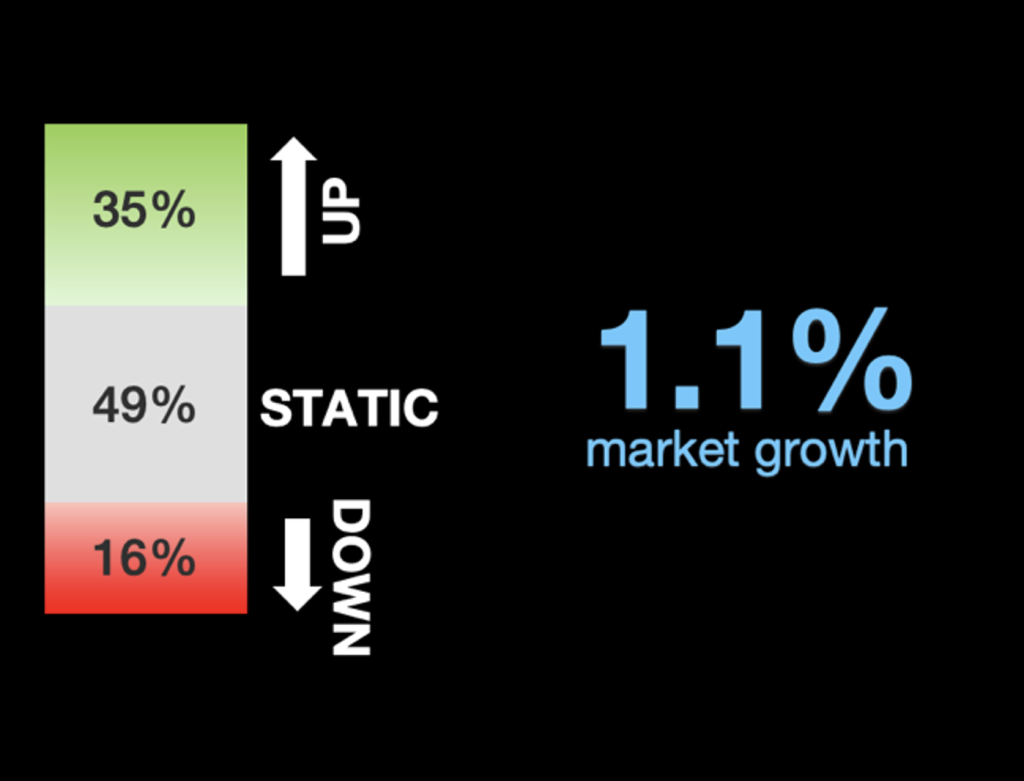

These indices track the values of specific cars in in the UK Hagerty Price Guide, so it’s possible to look in more detail at what is moving – and what isn’t. Over the past year, nearly half of all vehicle values have remained static, 16 percent have come down, and 35 percent have increased. Overall, the total Hagerty Condition 2 (Excellent) value has risen by 1.1 percent. This supports what the indices shows us: that more cars have risen in value than dropped, but those that have reduced in value tend to be the more expensive ones.

To confirm this, Hagerty looked at the two auction houses on our list that regularly offer more expensive (£800,000-plus) cars: Gooding & Company and Bonhams. Of the 11 Hampton Court lots estimated by Gooding & Company at this price point or higher, just five sold, and their sell-through rate of £100,000-plus cars was just 39 percent. Three of Bonhams’ top five Revival lots passed and did not sell.

Record Breakers

So, have all the buyers at the top of the market left the room? It seems not. In amongst the hesitation, some extremely strong individual sales were recorded. Gooding & Company set the record for a production E-Type with a £911,250 sale of roadster chassis number 850004, the first-ever E-Type sold, and with Jaguar’s own Frank ‘Lofty’ England the first owner. This broke a record assumed to have been set just weeks previously by a private sale of the second E-Type coupe to a private collector by Pendine Historic Cars working with William Heynes Ltd. Although the sale price was undisclosed, it is assumed to have set the previous record.

Then, there was Iconic Auctioneers’ top sale, a record-breaking £480,500 for a 1998 Subaru Impreza STi 22B, owned new by the late rally driver Colin McRae. This had everything going for it: one of three prototypes (including JDM-spec final drive), ownership by McRae, low mileage, and ‘excellent’ condition.

The McRae car sale was not just a 22B record, but the global top value paid for any car of the marque, following a trend of rapid price increases for top Subaru models that seems to be a post-lockdown phenomenon. The fact that the earliest 22B Imprezas are now at their 25-year point suggests that the US market would be clamouring for the car, but the top sales have mostly been here in the UK, with six of the top 10 overall Subaru record auction sales on this side of the Atlantic.

Subaru price increases were already a trend that we were tracking in the price guide, with the marque increasing year-on-year more than any other car brand, up 54 percent. That said, both the price guide increase and the top 25 Subaru values recorded at auction have something in common: They are all variants of one model, the Impreza. This means that the percentage rise is much more pronounced than for a marque that has numerous models produced over many years.

Rough Estimates

So, if the right cars are still selling well, why is there this drop in sale rates across all the summer UK auctions, no matter what sector of the market they cover? To answer that, Hagerty needed to delve into two more data sets.

One way of seeing how realistic estimates are is to compare the auctioneer’s combined low predicted value with the total bid value. For the Gooding & Company Hampton Court auction, the total bid value was 24 percent under the combined low estimate, a significant reduction from the -8 percent figure from a year ago. There was a similar story at the Bonhams Revival auction: Total bids were 11 percent under estimate (down from -3 percent last year). Between these two auctions, just 15 percent of lots reached low reserve, half of the 2022 figure. The other metric worth tracking is the number of lots offered with no reserve. This year, the two auctions combined offered just 13.6% percent of lots without reserve, just over half as many as offered last year (25 percent).

This seems to be the key to explaining what’s going on. Estimates are generally too high, and sellers are not willing to take a risk and offer at no reserve. That suggests that many sellers either have unrealistic expectations, or don’t really need to sell at that moment. Buyers are snapping up the really special cars, and paying strongly for the privilege of ownership, but they are sitting on their hands when anything not quite right or with a ‘story’ crosses the auction block. These figures may also reflect that sellers tend to look at sold prices over a longer period, or look at the top prices paid as a comparison to their car, in contrast to buyers who tend to compare with other cars available at the time of sale.

The auction market probably needed a summer like this, as it gave auction companies a chance to prove to their clients that they need to be more realistic when setting reserves, and that’s probably good for the market in the longer term. The other positive news is that Hagerty’s Classic Index, the one designed to track the UK enthusiast market, is now in percentage terms the biggest gainer of the year, and as high as it has ever been. With all the indices except Gold rising in the past quarter, the ‘market in turmoil’ headlines you may have read elsewhere seem to be rather premature.

Absolutely informative, and most appreciated. Hagerty is one of my prize sources of car information, I even love their YouTube channel.