On 3 April 1984, in a small American resort town called Traverse City, on the shore of Lake Michigan, Frank and Louise Hagerty started a business to sell insurance policies to owners of classic and collector wooden boats.

Insurers at the time considered these elegant, highly polished boats to be too risky and too few to bother with, so the Hagertys – who loved to cruise the local inland lakes in a Chris-Craft named Pipe Dream – did what entrepreneurs have always done when they detect an unfilled niche.

They filled it.

But success with a startup is never certain. After setting up the business, placing a few small ads in wooden boat magazines, and connecting a single phone line to an answering machine, they hoped for the best. Their first stroke of good luck happened on a road trip to Florida. McKeel, the youngest of the three Hagerty children after Kim and Tammy and today the company’s CEO, went into a phone booth to check the answering machine and see if anyone had left a message. He heard nothing. Silence. He worried that no one had called, that no one wanted wooden boat insurance after all. Moments later, he realised the tape wasn’t empty, the silence was the tape rewinding to the beginning. Instead, message after message was of boaters wanting quotes, so the family turned the car around and headed back to Michigan.

They didn’t know it at the time, but that moment would be the start of something big – for the Hagerty family and for car collectors and fans everywhere.

Forty years later, Hagerty has become the hub of a community for millions of classic car lovers, a publicly traded company on the New York Stock Exchange (HGTY), and a leading automotive membership, media, and event company that in 2023 passed a billion dollars in annual revenue for the first time.

Today, Hagerty employs nearly 1700 people worldwide, including about 500 in the Traverse City region, and insures more than 2.5 million vehicles. The company has an industry-leading Net Promoter Score of 82 (a gauge of customer loyalty for which the industry average is in the mid-40s) and partners with nine of the top 10 US automotive insurers, including State Farm, the nation’s largest insurer of private passenger vehicles.

Let’s flip the calendar back to 1984 and look at some of the company’s milestones along the way.

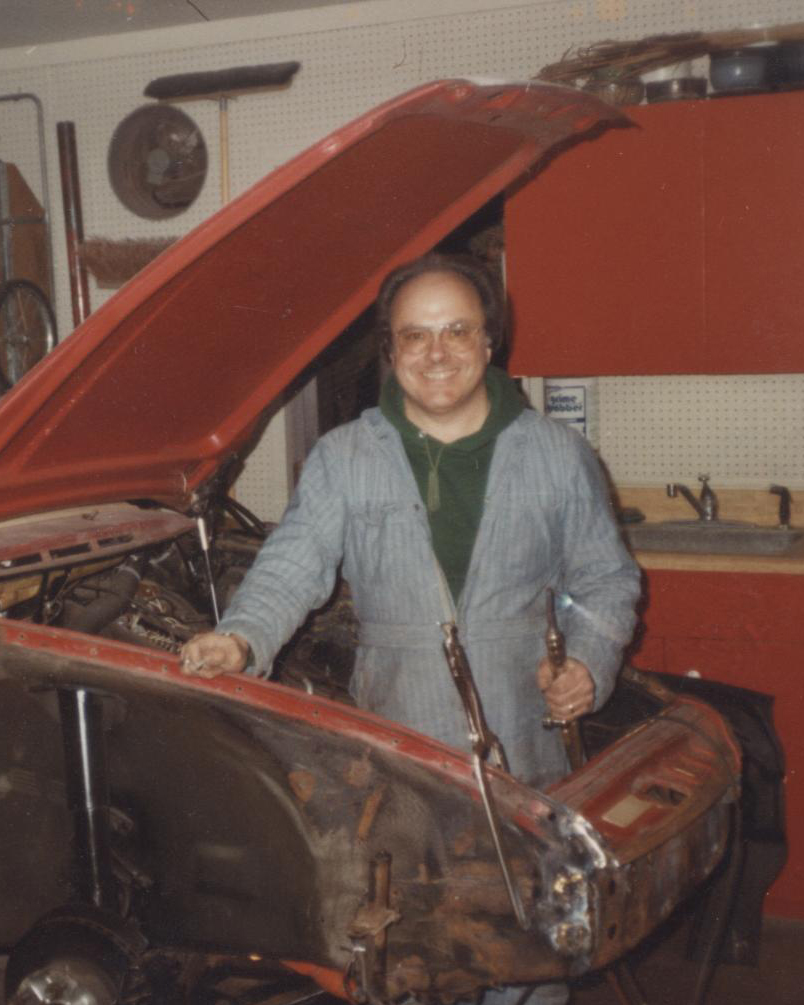

Down in the Basement

Almost from day one, the business grew quickly, with Frank serving as the charming impresario and Louise as the operational glue that held things together. She was Hagerty’s first CEO.

“Dad had some amazing innovations that were baked into the business early on. He was an absolute visionary, not an operations person, though,” McKeel says today. “That was where my mom came in. She set up all the stuff that made Hagerty efficient and run well.”

But they were beginning to outgrow the basement, especially now that they had five employees in addition to Grandma Helen, who lived in the house at the time, and there was only one bathroom.

“We were just sort of figuring it out as we went,” Tammy Hagerty recalls. “I’m so proud that we’re still using a lot of those early concepts: the service level, the claims, Guaranteed Value, repair shop of choice. To this day, those differentiators are part of what makes Hagerty unique and successful.”

After five years in the basement, the agency made two major changes: First, it moved into a proper office building called Grandview Plaza near downtown Traverse City. Second and most important, Hagerty started offering insurance for classic and collector cars, writing its first auto policy in 1991. Much of this was driven by customer demand. “So many of our wooden boat customers who also had cars kept asking us to cover them,” Tammy recalls. So, the family almost inadvertently started a second business to insure collector cars. This “spin off” makes up the bulk of the business today. The core principles were the same, however. As Louise famously answered when asked why the business worked so well: “People take good care of their toys.”

“She was right – we exist as a company because of that line,” says McKeel. “Where there is passion for something and genuine care, there exists better insurance risk.”

Built for People Who Love Cars

When the business first began, it was a true family partnership. Everyone pitched in. Kim, Tammy, and McKeel all did their part in the early days. But it was a few years on before the second-generation siblings made their way back to Michigan full-time and the business started hiring key people. Tammy was the first to return. She and that initial team learned the core concepts from Frank and started selling, underwriting, and handling claims. It was an “all hands on deck” time. “We all learned so much. And we did it in real time,” Tammy recalls.

In 1995, Kim and McKeel returned home from lives they’d built on the west and east coasts, respectively. Eventually, Kim stepped into the CEO role while McKeel became president. Later on, Kim and McKeel shared the CEO role for a number of years until Kim became the company’s first board chairperson. Kim, who passed away in 2021, was known for her friendly spirit, infectious laugh, sharp legal advice, and 1957 Thunderbird – a head-turner around town due to its pink paint job. She is often credited with keeping the family values at the forefront of the business as it grew.

In 1997, the Hagertys realised the company would never grow by advertising insurance. “Insurance is boring,” says McKeel. Instead, Hagerty marketing efforts were imbued with a “twinkle in the eye” approach that focused on cars, not insurance. The response was enormous.

By the early 2000s, the company had grown enough that it started giving back to the collector car industry. Starting with the Hagerty Fund, launched in 2002, Hagerty has to date invested more than $22 million in preserving car culture. This includes the creation of a national nonprofit, the Hagerty Drivers Foundation (HDF), which financially supports institutions teaching the critical skills needed to keep every vehicle on the road. The Foundation also provides driver education grants to young drivers through its License to the Future programme. In addition, the HDF has added 34 historic vehicles to the National Historic Vehicle Register, the only federally recognised programme that documents and celebrates America’s most significant automobiles, preserving their heritage in perpetuity at the Library of Congress.

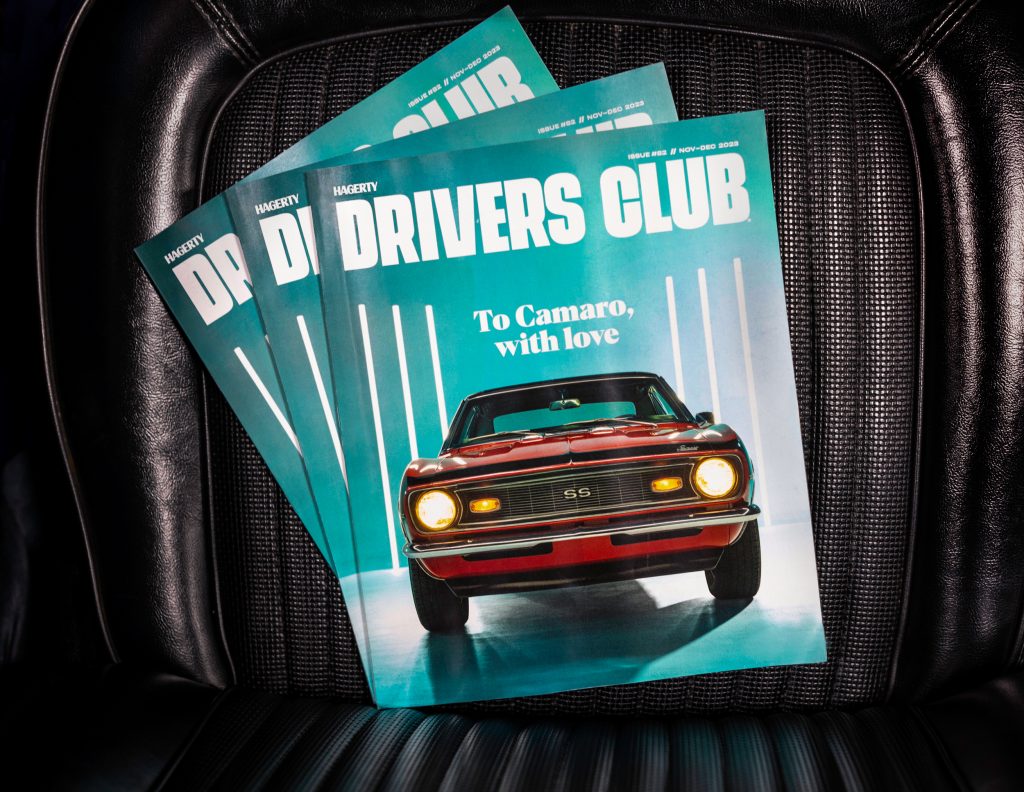

In 2018, to continue supporting automotive enthusiasts with more than insurance coverage, Hagerty began offering membership in Hagerty Drivers Club (HDC), which is the ultimate community in the US for car lovers, offering exclusive discounts, roadside services, member experiences, and more. The club currently has more than 800,000 members.

Developing a passion-based community was always one of McKeel’s dreams. “Cars have a way of bringing people together,” he says. “Everything we do at Hagerty is to help people get the most out of the passion they have for cars and driving, and HDC is a big part of that.”

One of HDC’s most popular offerings is Hagerty Drivers Club magazine, which has become America’s largest print automotive magazine, featuring the work of the industry’s top automotive journalists. Similarly, Hagerty’s YouTube channel has become a massive hit, boasting more than 3 million subscribers.

Events, Auctions, and the New York Stock Exchange

In recent years, Hagerty has stewarded multiple high-profile, national events, such as The Amelia, Greenwich Concours, Motorlux (formerly McCall’s Motorworks Revival), Festival of the Unexceptional, and RADwood, an ongoing series of events featuring ‘80s and ‘90s cars, music, and fashions that appeal to younger car collectors.

In December 2021, in perhaps the biggest moment in company history, Hagerty joined the New York Stock Exchange at a pro forma enterprise value of approximately $3.1 billion. At the time, McKeel said: “Today is a milestone for Hagerty and a testament to the talent and dedication of the entire Hagerty team and their commitment to our purpose of saving driving and car culture for future generations.”

In 2022, the company acquired Broad Arrow, which operates live and online collector car auctions. At its most recent two-day live auction at the 2024 Amelia, Broad Arrow sold more than $63 million (£50M) worth of cars, with a 92 per cent sell-through rate. Among the top lots were a 1967 Ford GT40, at $4,405,000; and a 2022 Bugatti Chiron Pur Sport, at $4,047,500. In its first two years of operation, Broad Arrow tallied more than $180 million in transactions across auctions, private sales, and financing, establishing Hagerty as a major player in the live auction space.

To McKeel, auctions are a natural extension of the company’s longstanding efforts to provide in-depth valuation data and analysis of market trends to the collector community through Hagerty Valuation Tools, Hagerty Price Guide, and Hagerty Insider.

“We’ve often said the world didn’t need another auction company, but it did need a better one,” says McKeel. “Buyers and sellers trust Hagerty, and that’s extremely important in the online and live auction worlds.

“Just like with the insurance side of the business,” he continues, “we thrive by taking underserved industries and making them better for car lovers.”

Most recently, the company announced Keepers of the Flame, a year-long creative campaign and an ode to the passion that millions of people share for cars and driving. The campaign kicked off in late March 2024 with an exciting, emotional video, which is available here.

For McKeel, the campaign is one more way of honouring the car community.

“More than 67 million Americans self-describe as car enthusiasts,” said McKeel. “We exist for them. I take pride in knowing their passion for cars is as vibrant as it was 40 years ago, and that Hagerty is playing a vital role in maintaining this community of car lovers for the next 40 years.”

And it all started in a Northern Michigan basement.

My wife and I were delighted to read of your parents early sailing days.My first sailing dinghy was wooden and after years of dinghy racing aching aged joints meant that we needed a keel boat and over the next 40 years we had a an excellent American Legend 33.5 in Mallorca and as a result of my daughter marrying a Greek we spent 6 weeks sailing the length of the Mediterranean and for the next 8 years we spent our holidays on the Isle of Simi.In 2000 we sold the boat and bought a Rover . It was insured with Admiral along with our Hyundai which is my runaround car for shopping doing about 3000 miles a year.Unfortunately the Hyundai insurance costs £1200 so my 20plus no claims bonus was transferred to the Rover which you now insure.In December I will be looking for cover on the Hyundai but I have only 2 years no claims bonus. However my Rover is my pride and joy when we spend a few days in the Cotswolds.Being 92 we no longer have long holidays but when I get in the car I feel much younger. Kind regards