- UK Hagerty Price Guide continuously tracks over 40,000 classic car values with a combined average market value of £466million

- Cars monitored range from 1923 Austin Seven to 2005 Honda NSX

- Hagerty UK reports an overall market rise of 9.4% in May 2020 with exchange rates fluctuations having a dramatic impact

- Despite increase, UK market sees enthusiast vehicles, such as MGB GT, fall in value during Covid-19 lockdown

- Online auctions deliver strong recent sales results and see strong hammer prices

Northamptonshire: 08 June 2020

In many ways, the most recent update to the UK Hagerty Price Guide is misleading. Overall, the average value of models on the guide is up 9.4% since the last update in November 2019, and at first glance it would appear the classic car market is bouncing back to full health. The reality, however, is slightly more nuanced as will be explained later.

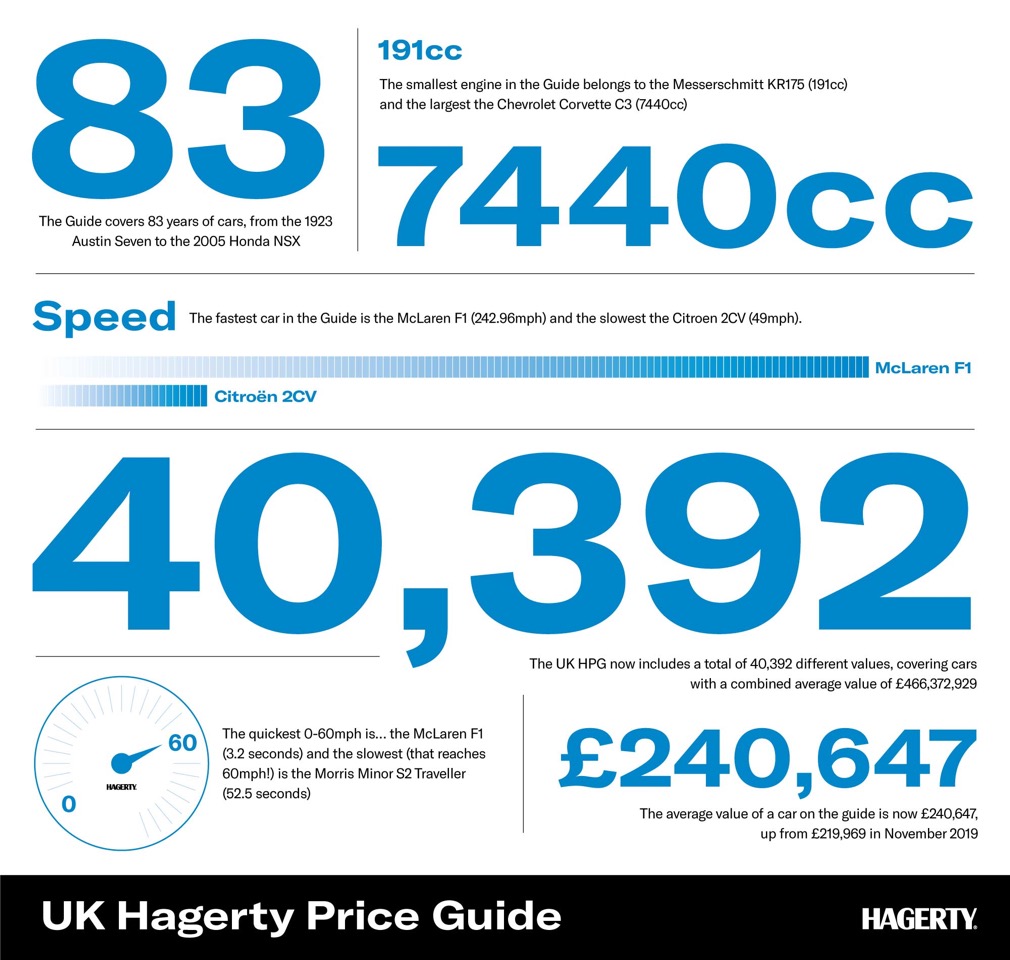

The UK Hagerty Price Guide report is compiled using an in-house database which tracks 40,392 classic car values with a combined average value of £466,372,929.

- The average value of a car within the UK Hagerty Price Guide database is £240,647

- It covers 83 years of cars, from the 1923 Austin Seven to the 2005 Honda NSX.

- The smallest engine car is the Messerschmitt KR175 (191cc) and the largest is the Chevrolet Corvette C3 (7440cc).

- The fastest car is the McLaren F1 (242.96mph) and the slowest the Citroen 2CV (49mph).

- The quickest 0-60mph is the McLaren F1 (3.2 seconds) and the slowest (able to reach 60mph) is the Morris Minor S2 Traveller (52.5 seconds).

- The 1960s alone accounts for 652 different models.

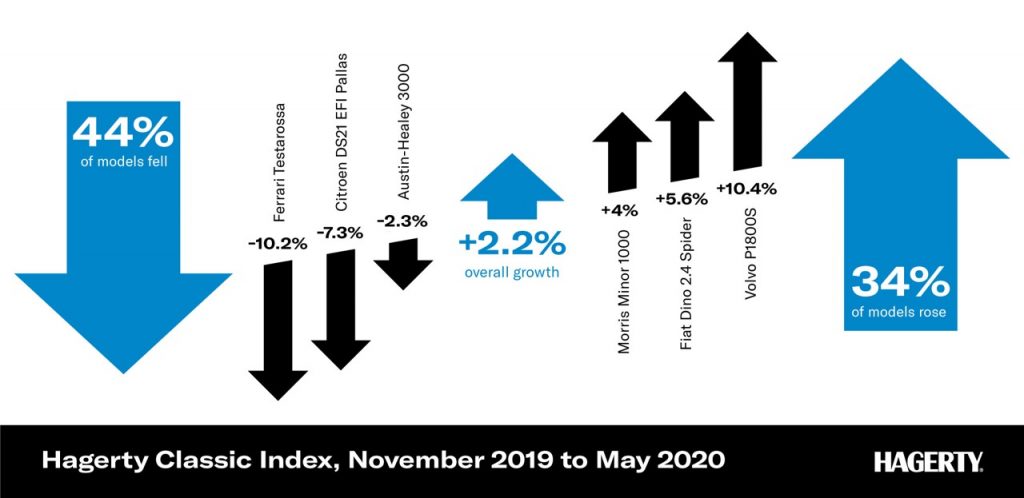

Within the database is the Hagerty Classic Index, where 50 of the UK’s most popular classics are specifically monitored. May Index analysis showed that 34% of models rose in value and 44% fell. Models included:

- Volvo P1800S up 10.44% – mean value rising to £23,000 from £21,075.

- Ferrari Testarossa down 10.2%, mean falling to £79,200 from £88,200.

- Jaguar E-Type SIII roadster remained static with an average mean value of £68,475.

Of the 44% that fell in value, the majority were enthusiast models such as the MGB GT (down 3.81%) and the Citroën DS21 (down 7.32%). The constraints of lockdown meant that most buyers were unable to view potential purchases which had an undeniable effect on the market. Those that did manage to sell, tended to be sold for less than they would have prior to lockdown.

With that in mind, what explains the 9.4% overall market rise already mentioned? One element is exchange rates. Some of our models – around 8% of those in the guide – are classed as ‘global’ cars. These are models that collectors would travel the globe to buy and, by their nature tend to be rare and often the most expensive models listed within the database.

Back in November 2019, when the US Dollar was worth 78 pence, the most expensive car in our guide was the Ferrari 250 GTO, valued at $66.7m or £52m. With exchange rate differences, the same car would be worth £54.6m today.

Another factor to be considered is that expensive cars tend to be perceived as investments. In turbulent times, tangible assets like cars can be attractive propositions and we’ve seen very high quality, very expensive cars change hands for very strong prices, even during global lockdown.

What does this all mean to an owner? Hagerty UK Head of Valuations John Mayhead said “Don’t worry about it too much. If you’re an enthusiast, just enjoy your car. Unless you absolutely have to sell, the current value is not very important except for insurance purposes. I’d recommend people wait for our next Price Guide update in September when, we hope, some semblance of normality has returned.”

Online auctions had a strong comeback in May with Silverstone Auctions reporting 76 of 87 cars offered within their 23rd May sale found new owners, giving an 87.4% sell-through rate. Even more impressively, 32 of those cars did so with bids that were greater than the top estimate, and in some cases significantly so. Bonhams May Sale at Bicester Heritage continued the trend with a strong 75% sell-through rate and H&H achieved a solid £464k in total sales, with a 59.5% sell-through rate.

An uplift in online auction searches was apparent during lockdown and now, with some constraints being relaxed, a flurry of purchasing seems to be taking place. This is likely to calm down again and we forecast a temporary spike.

Marcus Atkinson, Managing Director of Hagerty UK concluded “I am delighted to present the latest UK Hagerty Price Guide report to market. Hagerty UK is the leading resource for classic car market data and provides insight that cannot be found anywhere else. Having such a deep understanding of the classic car market allows us to accurately value our client’s vehicles and ensures we are closer to the market than any other provider. In addition, we provide quality classic car content via our digital, print and social channels and look forward to restarting our event program as soon as current restrictions lift”

ENDS

Editors Notes

About Hagerty

Hagerty Insurance Agency, LLC is the leading insurance agency for collector vehicles in the world and host to the largest network of collector car owners. Hagerty offers insurance for collector cars, motorcycles and even “automobilia” (any historic or collectible item linked with motor vehicles). The UK-based subsidiary, Hagerty International, was established in 2006 to cater for the parallel market sector in the UK and Europe, and now offers a bespoke portfolio of insurance products, underwritten by Hiscox, Aviva and Lloyd’s.

For more information, call 0333 323 0989 or visit www.hagertyinsurance.co.uk

Media enquiries: media@tonic-collective.com